Data Mining Approaches in Personal Loan Approval

doi: 10.14456/mijet.2022.2

Keywords:

Support Vector Machine, Multi-Layer Perceptron, Decision Tree, Feature Selection, Chi-square, Information Gain, Personal Loan ApprovalAbstract

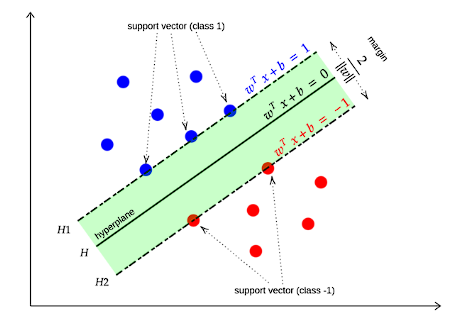

The approval of a bank's credit for an individual loan requires the fulfillment of several requirements, such as bank credit policy, loan amount, the purpose of the loan, and repayment ability. However, every type of credit is subject to the risk of non-repayment and non-performing loans, which affect the liquidity of the bank's operation. This research studied the application of data mining techniques to identify key factors for the loan decisions of a bank. The main objective was to compare the data mining process of personal loan approval process with and without feature selection techniques. For the experiments, the first step was to create the data mining models using three methods, including support vector machine (SVM), multi-layer perceptron (MLP), and decision tree. The results showed that the SVM method outperformed other data mining methods. Second, we experimented with feature selection techniques consisting of Chi-square and information gain. The Chi-square considered the ten factors, while information gain selected the best three factors. The experimental results showed that the Chi-square and information gain combined with the MLP method obtained an accuracy rate of 90.40% and 91.70%, respectively. Therefore, this research concluded that the SVM classifier without combining the feature selection method is the best method to use in personal credit evaluation.

References

[2] “The People Bank Project”, Loans of Government Savings Bank.” https://www.gsb.or.th/gsb_govs/bank_people/.

[3] H. Ince and B. Aktan, “A comparison of data mining techniques for credit scoring in banking: A managerial perspective,” J. Bus. Econ. Manag., vol. 10, no. 3, pp. 233–240, 2009, doi: 10.3846/1611-1699.2009.10.233-240.

[4] Y. B. Wah and I. R. Ibrahim, “Using data mining predictive models to classify credit card applicants,” Proc. - 6th Intl. Conf. Adv. Inf. Manag. Serv. IMS2010, with ICMIA2010 - 2nd Int. Conf. Data Min. Intell. Inf. Technol. Appl., pp. 394–398, 2010.

[5] H. A. Bekhet and S. F. K. Eletter, “Credit risk assessment model for Jordanian commercial banks: Neural scoring approach,” Rev. Dev. Financ., vol. 4, no. 1, pp. 20–28, 2014, doi: 10.1016/j.rdf.2014.03.002.

[6] A. Jafar Hamid and T. M. Ahmed, “Developing Prediction Model of Loan Risk in Banks Using Data Mining,” Mach. Learn. Appl. An Int. J., vol. 3, no. 1, pp. 1–9, 2016, doi: 10.5121/mlaij.2016.3101.

[7] P. Suksomboon and N. N. Jongkasikit. (2017). Effects of Models that Affect their Ability to Repay Loans of Member in Credit Union Cooperative. Industrial Technology Lampang Rajabhat University Journal, 10(1), 101–110

[8] Y. Sitthisan and P. Seresangtakul. (2018). The Model of Predicting Settlement Ability: A Case Study in Office of the Welfare Promotion Commission for Teachers and Educational Personnel, Udonthani Province, Thailand. Journal of Chemical Information and Modeling, 53(9), 1689–1699. https://doi.org/10.1017/CBO9781107415324.004

[9] S. Vilailuck, V. Jaroenpuntaruk and D. Wichadakul. (2015). Utilizing Data Mining Techniques to Forecast Student Academic Achievement of Kasetsart University Laboratory School Kamphaeng Saen Campus Educational Research and Development Center. Veridian E-Journal, Science and Technology Silpakorn University, 2(2), 1–17

[10] N. Chanamarn. (2014). Learning Attributes Analysis by Feature Selection and Prediction. Sakon Nakhon RajaBhat University Journal, 6(12), 31–46. https://ph01.tci-thaijo.org/index.php/snru_journal/article/view/26368

[11] S. Bahassine, A. Madani, M. Al-Sarem, and M. Kissi, “Feature selection using an improved Chi-square for Arabic text classification,” J. King Saud Univ. - Comput. Inf. Sci., vol. 32, no. 2, pp. 225–231, 2020, doi: 10.1016/j.jksuci.2018.05.010.

[12] S. Lei, “A feature selection method based on information gain and genetic algorithm,” Proc. - 2012 Int. Conf. Comput. Sci. Electron. Eng. ICCSEE 2012, vol. 2, pp. 355–358, 2012, doi: 10.1109/ICCSEE.2012.97.

[13] C. Vapnik. “Model complexity control and statistical learning theory,” Nat. Comput., vol. 1, no. 1, pp. 109–133, 2002, doi: 10.1023/A:1015007927558.

[14] G. Cheng and X. Tong, “Fuzzy clustering multiple kernel support vector machine,” Int. Conf. Wavelet Anal. Pattern Recognit., vol. 2018-July, pp. 7–12, 2018, doi: 10.1109/ICWAPR.2018.8521307.

[15] H. Elaidi, Y. Elhaddar, Z. Benabbou, and H. Abbar, “An idea of a clustering algorithm using support vector machines based on binary decision tree,” 2018 Int. Conf. Intell. Syst. Comput. Vision, ISCV 2018, vol. 2018-May, no. 5, pp. 1–5, 2018, doi: 10.1109/ISACV.2018.8354024.

[16] M. J. Flores Calero, M. Aldas, J. Lazaro, A. Gardel, N. Onofa, and B. Quinga, “Pedestrian detection under partial occlusion by using logic inference, HOG and SVM,” IEEE Lat. Am. Trans., vol. 17, no. 9, pp. 1552–1559, 2019, doi: 10.1109/TLA.2019.8931190.

[17] B. Meus, T. Kryjak, and M. Gorgon, “Embedded vision system for pedestrian detection based on HOG+SVM and use of motion information implemented in Zynq heterogeneous device,” Signal Process. - Algorithms, Archit. Arrange. Appl. Conf. Proceedings, SPA, vol. 2017-September, pp. 406–411, 2017, doi: 10.23919/SPA.2017.8166901.

[18] P. Liu, K. K. R. Choo, L. Wang, and F. Huang, “SVM or deep learning? A comparative study on remote sensing image classification,” Soft Comput., vol. 21, no. 23, pp. 7053–7065, 2017, doi: 10.1007/s00500-016-2247-2.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2021 Engineering Access

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.