The Development of Financial Information System

doi: 10.14456/mijet.2022.11

Keywords:

management information system, financial systemAbstract

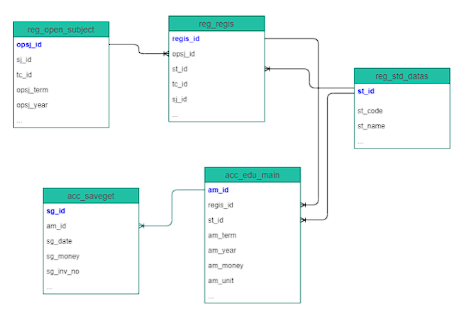

The purposes of this research were to develop the management information system for financial and to evaluate its efficiency. The problem with the original system is the financiers have to add the data using excel which makes the data out of date and difficult to find information calculating educational expenses such as enrollment fees, transfer fees, and other fees resulted in inconsistencies in data. So, the developer has brought this problem to research by asking for needs and developing the system in this research, there were 304 samples (computer professionals, finance and loan officers, and students) from Pitchayabundit College, Nong Bua Lamphu, Thailand. The research instruments were financial information systems which were accessible via the internet. The systems were developed with visual studio 2008 and Microsoft.NET framework 3.5 and used MySQL as a database. The data collected from the questionnaires were analyzed by using statistical evaluations: percentage, mean and standard deviation. The results of the research showed that financial information systems were highly effective and can actually be used in the context of the organization.

References

OECD, Digital delivery of financial education: design and practice. 2021. [Online]. Available https://www.oecd.org//financial/education/digital-delivery-of-financial-education-design-and-practice.htm [Accessed: Dec. 4, 2021].

M. Turoff, M. Chumer, B. V. de Walle and X. Yao, "The design of a dynamic emergency response management information system (DERMIS)," Journal of Information Technology Theory and Application (JITTA), vol. 5, no. 4, 2004, pp. 1-36.

A. H. Sequeira and S. Pai, "Financial Management Information System, "Financial Management Information System," 2012, pp.1-11.

C. J. Hendriks, "Integrated Financial Management Information Systems: Guidelines for effective implementation by the public sector of South Africa," South African Journal of Information Management, vol. 14, no. 1, pp. 1-9.

G. Una and C. Pimenta, "Integrated Financial Management Information Systems in Latin America: Strategic Aspects and Challenges," Public Financial Management in Latin America. Inter-American Development Bank. [Online]. Available: https://www.elibrary.imf.org/view/books/ [Accessed: Dec. 4, 2021].

S. F. Jo, "Complexity of ICT in education: A critical literature review and its implications," International Journal of education and Development using ICT, vol. 9, no. 1, 2013, pp. 112-125.

J. Christiaens, B. Reyniers and Rollé, "Impact of IPSAS on reforming governmental financial information systems: a comparative study," International Review of Administrative Sciences, vol. 76, no. 3, 2010, pp. 537-554.

A. Ameen and K. Ahmad, "Towards harnessing financial information systems in reducing corruption: a review of strategies," Australian Journal of Basic and Applied Sciences, vol. 6, no. 8, 2012, pp. 500-509.

D. P. Ballou, and H. L. Pazer, Designing information systems to optimize the accuracy-timeliness tradeoff. Information Systems Research, vol. 6, no. 1, 1995, pp. 51-72.

T. Rasool, and N. F. Warraich, "Does Quality matter: A systematic review of information quality of E-Government websites," In Proceedings of the 11th International Conference on Theory and Practice of Electronic Governance, April 2018, pp. 433-442.

A. M. Alrabei, "The influence of accounting information systems in enhancing the efficiency of internal control at Jordanian commercial banks," Journal of Management Information and Decision Sciences, vol. 24, no. 1, 2021, pp. 1-9.

M. A. Gonçalves, B. L. Moreira, E. A. Fox and L. T. Watson, "What is a good digital library?”–A quality model for digital libraries," Information processing & management, vol. 43, no. 5, 2007, pp. 1416-1437.

S. Moritz and O. Uzunkol, "A more efficient secure fully verifiable delegation scheme for simultaneous group exponentiations," In International Conference on Intelligent, Secure, and Dependable Systems in Distributed and Cloud Environments, 2018, pp. 74-93.

M. Gelderman, "The relation between user satisfaction, usage of information systems and performance," Information & management, vol. 34, no. 1, 1998, pp. 11-18.

G. Albaum, "Likert scale revisited," Market Research Society Journal, vol. 39, no. 2, 1997, pp. 1-21.

J. Callaghan, A. Savage and E. Peacock, "Financial information systems: Teaching REA semantics within an information engineering framework," South African Journal of Accounting Research, vol. 16, no. 1, 2015, pp. 59-80.

H. N. Hartikayanti, F. L. Bramanti and A. Gunardi, "Financial management information system: an empirical evidence," European Research Studies Journal, vol. 21, no. 2, 2018, pp. 463-475.

C. Jariyatantiwait and P. Jariyatantiwait, "An Empirical Study of the Number of Template Effects on the Efficiency of the Prototype of an Automated Logo Inspection Machine," Mahasarakham International Journal of Engineering Technology, vol. 5, no. 2, 2019, pp. 75-79.

A. H. Eralp, "Information Technology in Developing Nations: a study of lecturers’ attitudes and expertise with reference to Turkish teacher education," Journal of Information Technology for Teacher Education, vol. 5, no. 3, 1996, pp. 185-205.

M. Chiba, M. Sustarsic, S. Perriton and D. B. Edwards Jr, "Investigating effective teaching and learning for sustainable development and global citizenship: Implications from a systematic review of the literature," International Journal of Educational Development, vol. 81, 2021, 102337.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.