Technology for Identifying Determinants of Condominiums Responsible Property Investing in Thailand

Keywords:

responsible property investment, green buildings, investment strategy, building characteristics, condominiumAbstract

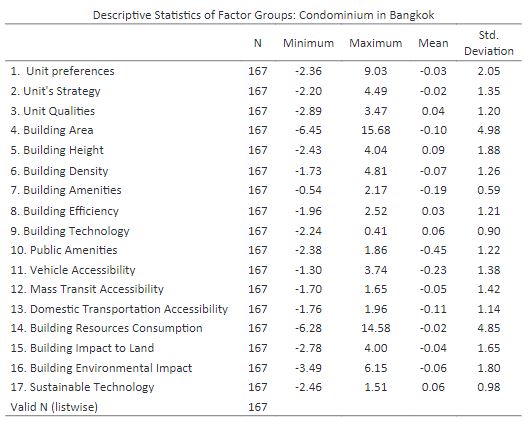

This article examines responsible property investment (RPI) determinants of condominiums in The Bangkok Metropolitan Region (BMR), Thailand. The researchers argue that sustainability is proven to hold benefits to investors, developers, and tenants. The development of RPI could strengthen their avoidance of irresponsible development, which results in asset values appreciation for those properties with better sustainability. The methodology used in this research is explanatory factor analysis (EFA) to classify the relationship between the potential dimensions of RPI. The study collected 167 cases from the owners’ resale of units between 2018-2019 and from 22 buildings. The results show 14-factor groups that represent the RPI dimensions of condominium buildings. The first 18% of the component represents the unit measurement, value-added, and intangible quality of the unit. Then, 35% of the factors serve financing expenses on the project, such as marketing costs and features and characteristics of the building. The last 47% of the factors represent the location and environmental responsibility. This study demonstrates that RPI can lead developers to be more responsible for their investment as well as performing strategy marketing and financing benefit. RPI standards help customers aware of the product choices of purchases that are responsible for the environment and society. The additional benefit of RPI is that it updates the green building assessment tool to be more favorable for the investment strategy. The result will also be the foundation of RPI research in Thailand. In the end, RPI can establish a common ground objective to develop and implement a long-term sustainable strategy from investment, development, management, and corporate activities with other organizations.

Downloads

References

Addae-Dapaah, K., Hiang, L. K., & Sharon, N. Y. S. (2009). Sustainability of sustainable real property development. Journal of Sustainable Real Estate, 1(1), 203-225.

Bienert, S. (2016). Climate Change Implications for Real Estate Portfolio Allocation-Business as usual or game shift.

Bishop, I. D., Lange, E., & Mahbubul, A. M. (2004). Estimation of the influence of view components on high-rise apartment pricing using a public survey and GIS modeling. Environment and Planning B: Planning and Design, 31(3), 439-452.

Bryant, F. B., & Yarnold, P. R. (1995). Principal- components analysis and exploratory and confirmatory factor analysis.

Chau, K., Ma, V., & Ho, D. (2001). The pricing of ‘luckiness’ in the apartment market. Journal of real estate literature, 9(1), 29-40.

Chen, Z. M., Ohshita, S., Lenzen, M., Wiedmann, T., Jiborn, M., Chen, B., Lester, L., Guan, D., Meng, J., Zu, S., Chen, G., Zheng, Z., Xue, J., Alsaedi, A., Hayat, T., & Liu, Z. (2018). Consumption-based greenhouse gas emissions accounting with capital stock change highlights dynamics of fast-developing countries. Nature communications, 9(1), 1-9.

Child, D. (2006). The essentials of factor analysis: A&C Black.

Cliff, N. (1988). The eigenvalues-greater-than-one rule and the reliability of components. Psychological bulletin, 103(2), 276.

Conley, V. A. (2019). Inhabiting luxury spaces. The Third Realm of Luxury: Connecting Real Places and Imaginary Spaces, 67.

Costello, A. B., & Osborne, J. (2005). Best practices in exploratory factor analysis: Four recommendations for getting the most from your analysis. Practical assessment, research, and evaluation, 10(1), 7.

Diewert, W. E., & Shimizu, C. (2016). Hedonic regression models for Tokyo condominium sales. Regional science and urban economics, 60, 300-315.

Division of Environmental Impact Assessment Development. (2018). Smart EIA for Thai. http://eia.onep.go.th/index.php

Ebeling, J., & Yasué, M. (2008). Generating carbon finance through avoided deforestation and its potential to create climatic, conservation and human development benefits. Philosophical Transactions of the Royal Society B: Biological Sciences, 363(1498), 1917-1924.

Eichholtz, P., Kok, N., & Yonder, E. (2012). Portfolio greenness and the financial performance of REITs. Journal of International Money and Finance, 31(7), 1911-1929.

Fabrigar, L. R., Wegener, D. T., MacCallum, R. C., & Strahan, E. J. (1999). Evaluating the use of exploratory factor analysis in psychological research. Psychological methods, 4(3), 272.

Falcone, S. M. (2019). Designing Single-Family Residences: A Study of the Positive Impact of Interior Design in Creating New Home Value.

Foo, M. (2017). A review of socially responsible investing in Australia. An independent report for National Australia Bank (NAB) by the Australian Centre for Financial Studies (ACFS) at Monash Business School.

Galley, L., Rogers, J., & Wood, D. (2009). Metrics for Responsible Property Investing: Developing and Maintaining a High Performance Portfolio. Paper presented at the Urban Land Institute Fall Council Forum, Los Angeles, CA.

Goering, J. (2009). Sustainable real estate development: the dynamics of market penetration. Journal of Sustainable Real Estate, 1(1), 167-201.

Guadagnoli, E., & Velicer, W. F. (1988). Relation of sample size to the stability of component patterns. Psychological bulletin, 103(2), 265.

Hamilton, V. L. (1978). Who is responsible? Toward a social psychology of responsibility attribution. Social Psychology, 316-328.

Harlan, S. L., & Ruddell, D. M. (2011). Climate change and health in cities: impacts of heat and air pollution and potential co-benefits from mitigation and adaptation. Current Opinion in Environmental Sustainability, 3(3), 126-134.

Hebb, T., Hamilton, A., & Hachigian, H. (2010). Responsible property investing in Canada: factoring both environmental and social impacts in the Canadian real estate market. Journal of Business Ethics, 92(1), 99-115.

Hogarty, K. Y., Kromrey, J. D., Ferron, J. M., & Hines, C. V. (2004). Selection of variables in exploratory factor analysis: An empirical comparison of a stepwise and traditional approach. Psychometrika, 69(4), 593-611.

Hollander, R. (2010). Rethinking overlap and duplication: federalism and environmental assessment in Australia. Publius: The Journal of Federalism, 40(1), 136-170.

Imperatives, S. (1987). Report of the World Commission on Environment and Development: Our common future. Accessed on 10 Febuary 1983.

Jung, S., & Lee, S. (2011). Exploratory factor analysis for small samples. Behavior research methods, 43(3), 701-709.

Kaklauskas, A., Zavadskas, E. K., Bardauskien, D., & Dargis, R. (2015). Sustainable development of real estate. In.

Kampanaraki, A. (2018). Responsible Property Investing in European Union State Members. Kano, Y., & Harada, A. (2000). Stepwise variable selection in factor analysis. Psychometrika, 65(1), 7-22.

Khumpaisal, S. (2015). An examination of economic risks’ perception of Thai real estate developers. International Journal of Trade, Economics and Finance, 6(1), 14.

Klinchuanchun, P. (2018). Thailand Industry outlook 2018- 20 : Housing in BMR. Retrieved from

Knight, F. (2019). Bangkok Condo Market, Thailand 1H 2019 - 1H 2019. retrieved from https://www.knightfrank.co.th/

Komai, M., Moridaira, S., Kitamura, K., Morinaga, A., & Yoshida, Y. (2002). The change in the prices of attributes for newly-built condominiums in Tokyo metropolitan area. Jisedai Saiba Supesu no Kenkyu Heisei, 13, 307-326.

Krajnc, D., & Glavič, P. (2005). A model for integrated assessment of sustainable development. Resources, Conservation and Recycling, 43(2), 189-208.

Kriese, U. (2009). Business and marketing strategies in responsible property investment. Journal of Property Investment & Finance, 27(5), 447-469.

Lieske, S. N., Nouwelant van den, R., Han, J. H., & Pettit, C. (2019). A novel hedonic price modelling approach for estimating the impact of transportation infrastructure on property prices. Urban Studies. Retrived from https://doiorg/10.1177/0042098019879382

Lönnberg, L. (2019). Value Creation Through Home Staging in Real Estate Market.

Lützkendorf, T., & Lorenz, D. P. (2006). Using an integrated performance approach in building assessment tools. Building Research & Information, 34(4), 334-356.

Mohamad, I. B., & Usman, D. (2013). Standardization and its effects on K-means clustering algorithm. Research Journal of Applied Sciences, Engineering and Technology, 6(17), 3299-3303.

Newell, G. (2009). Developing a socially responsible property investment index for UK property companies.Journal of Property Investment & Finance, 27(5), 511-521.

Pagourtzi, E., Assimakopoulos, V., Hatzichristos, T., & French, N. (2003). Real estate appraisal: a review of valuation methods. Journal of Property Investment & Finance.

Patil, V. H., Singh, S. N., Mishra, S., & Donavan, D. T. (2008). Efficient theory development and factor retention criteria: Abandon the ‘eigenvalue greater than one’criterion. Journal of Business Research, 61(2), 162-170.

Peterson, R. A. (2000). A meta-analysis of variance accounted for and factor loadings in exploratory factor analysis. Marketing Letters, 11(3), 261-275.

Pivo, G. (2008). Responsible property investment criteria developed using the Delphi Method. Building Research & Information, 36(1), 20-36.

Pivo, G., & Fisher, J. (2009). Investment returns from responsible property investments: energy efficient, transit-oriented and Urban regeneration office properties in the US from 1998-2007. Responsible Property Investing Center, Boston College, University of Arizona, Benecki Center for Real Estate Studies, and Indiana University, Working Paper WP-08-2, rev.

Pivo, G., & McNamara, P. (2005). Responsible property investing. International Real Estate Review, 8(1), 128-143.

Polesello, V., & Johnson, K. (2016). Energy-efficient buildings for low-carbon cities. ICCG Reflection(47).

Preacher, K. J., & MacCallum, R. C. (2002). Exploratory factor analysis in behavior genetics research: Factor recovery with small sample sizes. Behavior genetics, 32(2), 153-161.

Puncreobutr, V., Pusapukdepop, J., & Khamkhong, Y. (2017).Overheads Cost Management in Condominium Construction Project in Thailand. Retrived from https://ssrn.com/abstract=2970414

Rattanaprichavej, N. (2020). Possibilities and challenges of sustainable condominium development in Thailand: an analysis through the circle of blame concept. Pacific Rim Property Research Journal, 1-22.

Reichardt, A., Fuerst, F., Rottke, N., & Zietz, J. (2012). Sustainable building certification and the rent premium: a panel data approach. Journal of Real Estate Research, 34(1), 99-126.

Robins, N., Gouldson, A., Irwin, W., & Sudmant, A. (2019).Investing in a just transition in the UK How investors can integrate social impact and place-based financing into climate strategies. Lse. Ac. Uk.

Sah, V., Miller, N., & Ghosh, B. (2013). Are green REITs valued more? Journal of Real Estate Portfolio Management, 19(2), 169-177.

Säynäjoki, A., Heinonen, J., & Junnila, S. (2012). A scenario analysis of the life cycle greenhouse gas emissions of a new residential area. Environmental Research Letters, 7, 3(September 2012).

Shen, L., Zhang, Z., & Long, Z. (2017). Significant barriers to green procurement in real estate development. Resources, Conservation and Recycling, 116, 160-168.

Squires, G., & Moate, J. (2012). Socially responsible property investment in urban regeneration/Priorities and behaviours of institutional investors in practice. Journal of Urban Regeneration & Renewal, 5(2), 152-163.

Stapleton, C. D. (1997). Basic Concepts in Exploratory Factor Analysis (EFA) as a Tool To Evaluate Score Validity: A Right-Brained Approach.

Tochaiwat, K., Likitanupak, W., & Kongsuk, S. (2017). Location Selection Model for Low-rise Condominium Development in Bangkok. Veridian E-Journal, Silpakorn University (Humanities, Social Sciences and arts), 10(4), 430-444.

Trabucco, D., & Miranda, W. D. (2019). Measuring the Floor Area of Buildings: Problems of Consistency and a Solution. Journal of Civil Engineering and Architecture, 13, 107-114.

UNEP-FI. (2016). Real Estate Investment Implementing the Paris Climate Agreement: an Action Frame work. Retrieved from http://www.unepfi.org/fileadmin/documents/SustainableRealEstateInvestment.pdf,

UNEP FI, & PRI signatories. (2018). Building responsible property portfolios: A review of current practice by UNEP FI and PRI signatories. Retrieved from https://www.unepfi.org/fileadmin/documents/building_responsible_property_portfolios.pdf

United Nations Environment Programme Finance Initiative. (2014). Responsible Property Investment. Retrieved from http://www.unepfi.org/investment/property/

Williams, B., Onsman, A., & Brown, T. (2010). Exploratory factor analysis: A five-step guide for novices. Australasian Journal of Paramedicine, 8(3). Article 990399.

Wonggotwarin, T., & Kim, S. (2017). THE PRODUCTS’ FACTORS AFFECTING PURCHASE INTENTION: A CASE STUDY OF CONDOMINIUM IN BANGKOK, THAILAND. AU-GSB e-JOURNAL, 10(1), 214.

Wongleedee, K. (2017). Important marketing decision to purchase condominium: A case study of Bangkok, Thailand. The Business and Management Review, 9(1), 122-125.

Yong, A. G., & Pearce, S. (2013). A beginner’s guide to factor analysis: Focusing on exploratory factor analysis. Tutorials in quantitative methods for psychology, 9(2), 79-94.

Zhang, X., Shen, L., Wu, Y., & Qi, G. (2011). Barriers to implement green strategy in the process of developing real estate projects. The Open Waste Management Journal, 4(1), 33-37.

Zhuge, C., Shao, C., Gao, J., Dong, C., & Zhang, H. (2016). Agent-based joint model of residential location choice and real estate price for land use and transport model. Computers, Environment and Urban Systems, 57, 93-105.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2020 International Journal of Building, Urban, Interior and Landscape Technology (BUILT)

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.