Factors affecting dividend policy: Evidence from manufacturing company in Indonesia

Main Article Content

Abstract

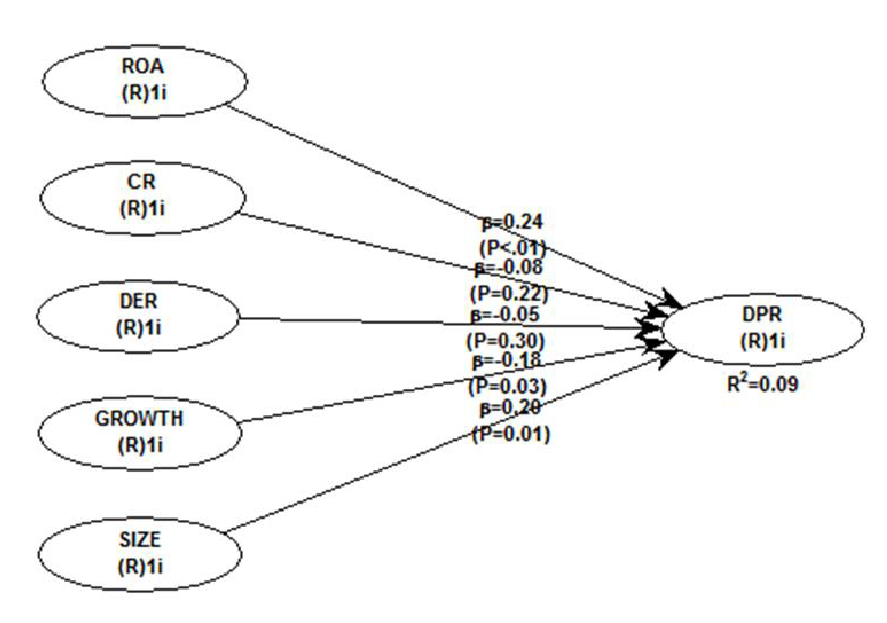

The goal of the current research was to prove the effect of profitability, liquidity, leverage, company growth and company size to the dividend policy. Object of the research was manufacturing companies listed in Indonesia Stock Exchange, period 2016 -- 2018. Sampling method used purposive sampling. Method of data analysis used Structural Equation Modeling (SEM) with Warp PLS 4.0. Based on the analysis, profitability, company growth and company size significantly affected to dividend policy, while liquidity and leverage did not significantly affect to dividend policy. For future research, it should make synthesis research with other factors influencing dividend policy. For go public companies, knowing that dividend policy is one of the most considerations by investors in investing, they should make the best dividend policy to attract investors to invest.

Article Details

References

E. F. Brigham, J. F. Houston, Financial management, Jakarta: Erlangga, 2011.

M. Hanif, Bustaman, Effect of debt to equity ratio, return on assets, firm size, and earning per share on dividend payout eatio (study on manufacturing companies listed on the Indonesia stock exchange in 2011-2015), Scientific Journal of Accounting Economics Students 2(1) (2017) 73--81.

S. Wicaksono, M. Nasir, Factors that affect dividend policy on manufacturing companies listed on the Indonesia stock exchange for the period of 2011-2013, Diponegoro Journal of Accounting 3(4) (2014) 1--13.

L. A. N. Sari, L. K. Sudjarni,. Effect of liquidity, leverage, company growth, and profitability on dividend policy in manufacturing companies on the IDX, E-Journal Management Unud 4(10) ( 2015).

W. Laim, Analysis of factors affecting dividend payout ratio in companies listed on the LQ-45 index of the Indonesia stock exchange, Journal EMBA 3(1) (2015) 1129--1140.

M. W. Swastyastu, Analysis of factors affecting dividend payout ratio policy listed on the Indonesia stock exchange (IDX), E-Journal S1 Ak Ganesha Institute University 2(1) (2014).

L. N. I. Sari, M. P. Priyadi, Factors affecting the return on investment in manufacturing companies on the IDX, Journal of Accounting and Research 5(10) (2016).

J. C. Horne, J. M. Wachowicz, Financial management, Jakarta: Salemba Empat, 2014.

L. F. I. Mawarni, N. M. D. Ratnadi, Effect of investment opportunities, leverage, and liquidity on dividend policies of manufacturing companies listed on the IDX, E-Journal Accounting Udayana University 9(1) (2014).

G. N. Ahmad, The effect of fundamental factor to dividend policy: Evidence in Indonesia stock exchange, International Journal of Business and Commerce 4(2) (2014).

N. P. Y. Devi, N. M. A. Erawati, The effect of managerial ownership, leverage, company growth, and profitability on dividend policy in manufacturing companies, E-Journal Accounting Udayana University 9(3) (2014).

C. D. Ittner, F. L. David, V. R. Madhav, The choice of performance measures in annual bonus contracts, Accounting Review (1997) 231--255.

S. Papadopoulos, Y. Amemiya, Correlated samples with fixed and nonnormal latent variables, The Annals of Statistics 33(6) (2005) 2732--2757.

S. Wold, et al., The collinearity problem in linear regression (1974) The partial least squares (PLS) approach to generalized inverses, SIAM Journal on Scientific and Statistical Computing 5(3) (1974) 735--743.

L. Lee, S. Petter, D. Fayard, s. Robinson, On the use of partial least squares path modeling in accounting study, International Journal of Accounting Information Systems 12(4) (2011) 305--328.

J. Hair, W. Black, B. Babin, R. Anderson, Multivariate data analysis: A global perspective, New Jersey: Pearson, 2010.