Factors Influencing Investment Intention Among Gen Z: The Antecedent of India

Main Article Content

Abstract

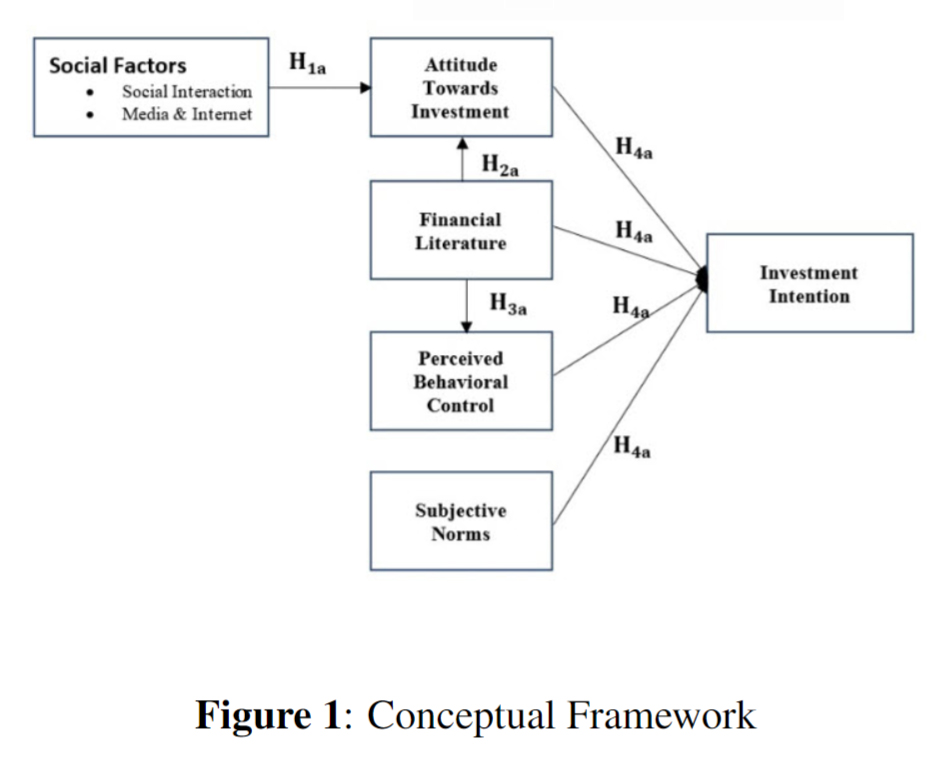

This study aims to explore and study the factors which influence the investment intention of an individual belonging to Gen Z to invest in the stock market in India. The study uses the 3 constructs of the Theory of Planned which are attitude toward behavior, subjective norms, and perceived behavioral control. In addition, two more constructs have been added to determine the investment intention which are financial literacy and social factors. This study focuses on investment intention among Gen Z in India and this topic is still not explored much. The study uses a quantitative approach wherein a questionnaire-based survey was done to collect responses from Gen Z individuals or Gen Zers (401 valid responses). A simple and multiple linear regression model has been applied for hypothesis testing using statistical software (SPSS-23). The results of this study show a significant influence of social factors and financial literacy on attitude toward investment. Furthermore, financial literacy also has a strong positive influence on perceived behavioral control. Moreover, attitude toward investment, financial literacy, perceived behavioral control, and subjective norms have a significant positive influence on investment intention. Significantly, financial literacy was found among Gen Z in India. The findings could be useful for ministers and policymakers to make some changes in the education courses so that students can be made more aware of the basics of the stock market. Also, this result is imperative to stockbrokers and publishers by giving them an insight into the opinion of Gen Z regarding investment in the stock market. Moreover, financial service providers can benefit by understanding the needs of Gen Z.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

. Ajzen, I. and Fishbein, M. (1980), Understanding Attitudes and Predicting Social Behaviour, Prentice-Hall, Englewood Cliffs, NJ.

. Akhtar, F., & Das, N. (2019). Predictors of investment intention in Indian stock markets. 37(1), 97–119. https://doi.org/10.1108/IJBM-08-2017-0167

. Albaity, M. and Rahman, M. (2019), “The intention to use Islamic banking: an exploratory study to measure Islamic financial literacy”, International Journal of Emerging Markets, Vol. 14 No. 5, pp. 988-1012.

. Bansal, H. and Taylor, S. (2002), “Investigating interactive effects in the theory of planned in a service-provider switching context”, Psychology and Marketing, Vol. 19 No. 5, pp. 407-442.

. Bondia, R., Biswal, P. C., & Panda, A. (2019). The unspoken facets of buying by individual investors in Indian stock market. Review of al Finance, 11(3), 324–351. https://doi.org/10.1108/RBF-12-2017-0121

. Bucher-Koenen, T. and Ziegelmeyer, M. (2011), “Who lost the most? financial literacy, cognitive abilities, and the financial crisis”, pp. 1-37.

. Buttle, F. A. (1998). Word of mouth: understanding and managing referral marketing. Journal of Strategic Marketing, Vol. 6, pp. 241-254.

. Celerier, C., Vallee, B., Calvet, L.E. and Sodini, P. (2016), “Financial innovation and stock market participation”.

. Chen, M.F. (2007), “Consumer attitudes and purchase intentions in relation to organic foods in Taiwan: moderating effects of food-related personality traits”, Food Quality and Preference, Vol. 18 No. 7, pp. 1008-1021.

. Fishbein, M. and Ajzen, I. (1975), Belief, Attitude, Intention, and Behaviour: An Introduction to Theory and Research, Addison-Wesley Pub. Co., Chicago, Reading, MA.

. Ghen K.J and Liu G.M., (2004), ‘Positive brand extension trial and choice of parent brand’, Journal of Production Brand Management, 13,1, 25-36.

. Han, J.J. and Jang, W. (2013), “Information asymmetry and the financial consumer protection policy”, Asian Journal of Political Science, Vol. 21 No. 3, pp. 213-223.

. Haritha, P. H., & Uchil, R. (2020). In fl uence of investor sentiment and its antecedent on investment decision-making using partial least square technique. https://doi.org/10.1108/MRR-06-2019-0254

. Hietanen, T. (2017). University students’ attitudes s investing: A comparison between the United Kingdom and Finland. Helsinki Metropolia University of Applied Sciences. https://doi.org/10.13140/RG.2.2.10999.62884

. Hogarth, J. M., & Hilgert, M. A. (2002). Financial literacy and family and consumer sciences. Journal of Family and Consumer Sciences, 48, 1–7.

. Hung, Angela, Andrew M. Parker, and Joanne Yoong. "Defining and measuring financial literacy." (2009).

. Islamoğlu, M., Apan, M., & Ayvali, A. (2015). Determination of factors affecting individual investor behaviours: A study on bankers. International Journal of Economics and Financial Issues, 5(2), 531–543. https://doi.org/10.13140/RG.2.1.1932.6880

. Kan, M. P. H., Fabrigar, L. R., & Fishbein, M. (2017). Encyclopedia of Personality and Individual Differences. Encyclopedia of Personality and Individual Differences, 1–8. https://doi.org/10.1007/978-3-319-28099-8

. Mandell, L. (2008), The Financial Literacy of Young American Adults, The Jumpstart Coalition for Personal Financial Literacy, WA, DC.

. Mandell, L., & Klein, L. S. (2009). The impact of financial literacy education on subsequent financial behavior. Journal of Financial Counseling and Planning, 20(1).1-10

. Matters, C.R. (2008), “Countries and culture in al finance”, In CFA Institute Conference ProceedingsQuarterly, Vol. 25No. 3, pp. 38-44.

. Metawa, N., Hassan, M. K., Metawa, S., & Safa, M. F. (2019). Impact of al factors on investors’ financial decisions: case of the Egyptian stock market. International Journal of Islamic and Middle Eastern Finance and Management, 12(1), 30–55. https://doi.org/10.1108/IMEFM-12-2017-0333

. Moueed, A., Hunjra, A. I., Asghar, M. U., & Raza, B. (2015). Role of Psychological and Social Factors on Investment Decision of Individual Investors in Islamabad Stock Market. Science International, 27(5), 4697–4706.

. Mouna, A. and Anis, J. (2017), “Financial literacy in Tunisia: its determinants and its implications on investment behaviour”, Research in International Business and Finance, Vol. 39, Part A, pp. 568-577.

. Nagarajan, H. K., Sethi, D. V, Pradhan, K. C., Mukherjee, S., & Singh, S. K. (2011). How Households Save and Invest : Evidence from NCAER Household Survey. July, 1–125. www.ncaer.org

. Nofsinger, John R., (2005), ‘Social Mood and Financial Economics’, The Journal of Behavioural Finance, 6,3, 144-60.

. Nofsinger, John R., (2002a), ’Investment blunders’, Upper Saddle River,NJ: Financial Times Prentice. Hall.

. Norman, P., Webb, T.L. and Millings, A. (2019), “Using the theory of planned behaviour and implementation intentions to reduce binge drinking in new university students”, Psychology and Health, Vol. 34 No. 4, pp. 478-496.

. O’Connor, E.L. and White, K.M. (2010), “Willingness to trial functional foods and vitamin supplements: the role of attitudes, subjective norms, and dread of risks”, Food Quality and Preference, Vol. 21 No. 1, pp. 75-81.

. On, S., Of, R., & Factorsinvestment, D. (2012). , m. r. 10(1), 14–27.

. Raut, R. K. (2020). Past behaviour, financial literacy and investment decision-making process of individual investors. International Journal of Emerging Markets, 15(6), 1243–1263. https://doi.org/10.1108/IJOEM-07-2018-0379

. Raut, R. K., Kumar, R., & Das, N. (2020). Individual investors’ intention s SRI in India: an implementation of the theory of reasoned action. Social Responsibility Journal, July. https://doi.org/10.1108/SRJ-02-2018-0052

. Schmidt, N. (2010), “What drives investments into mutual funds? Applying the theory of planned behaviour to individuals’ willingness and intention to purchase mutual funds”, in Conference Proceeding, available at: http://retailinvestmentconference.org.

. Shanmugham, R., & Ramya, K. (2012). 2nd Annual International Conference on Accounting and Finance ( AF 2012 ) Impact of Social Factors on Individual Investors ’ Trading Behaviour. 2(Af),237–246. https://doi.org/10.1016/S2212 5671(12)00084-6

. Shiller, Robert., (2000), ‘Irrational Exuberance’, Princeton, N J: Princeton University Press , pp. 149-153.

. Sivaramakrishnan, S., Srivastava, M., & Rastogi, A. (2017). Attitudinal factors, financial literacy, and stock market participation. International Journal of Bank Marketing, 35(5), 818–841. https://doi.org/10.1108/IJBM-01-2016-0012

. Taylor, S. and Todd, P. (1995), “An integrated model of waste management ”, Environment and , Vol. 27 No. 5, pp. 603-663

. Thomas, A. and Spataro, L. (2018), “Financial literacy, human capital and stock market participation in Europe”, Journal of Family and Economic Issues, Vol. 39 No. 4, pp. 532-550.

. Verweij, J. I., & Düzce, S. B. (2011). Effects of Social Interaction in Financial Markets. Economics and Business Administration, Bachelor.

. Wu, K., Yu, Y., & Dong, D. (2020). Does advertising really work?: The direct stimulating and attention-grabbing effects of advertising on investor . International Journal of Accounting and Information Management, 28(3), 497–515. https://doi.org/10.1108/IJAIM-10-2019-0119

. Zait, A., & Bertea, P. E. (2014). Financial Literacy – Conceptual Definition and Proposed Approach for a Measurement Instrument. 4(3), 37–42.