Exchange Rate Volatility and Cointegration of ASEAN Member Countries

Main Article Content

Abstract

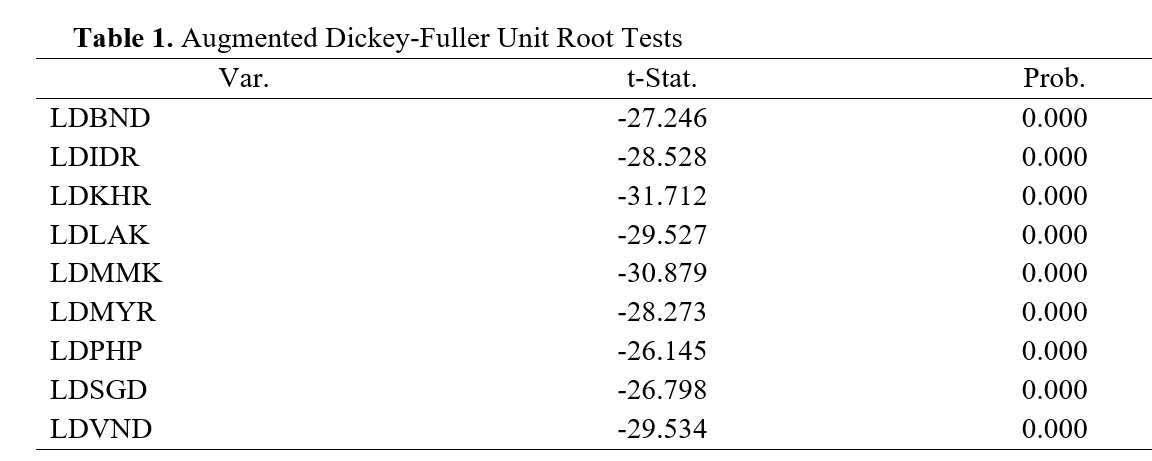

This study investigates the volatility and cointegration of exchange rates in nine selected ASEAN member countries using five forms of the GARCH model. Daily data was sourced from the Bank of Thailand website, as Baht per foreign currency, over the period from October 2, 2018 to October 7, 2022. This data included Malaysia Ringgit, Singapore Dollar, Brunei Darussalam Dollar, Philippines Peso, Indonesia Rupiah, Myanmar Kyat, Cambodia Riel, Laos Kip, and Vietnam Dong. According to the findings of this study, only eight exchange rates were suitable for analysis. The GARCH (1,1), TGARCH (1,1), and PGARCH (1,1) models were determined to be the most applicable, with leverage effects observed in certain exchange rates. The analysis revealed a long run and short run relationship between these exchange rates. In order to mitigate the associated risk, investors and governments should carefully monitor news that may affect the value of exchange rates. It is thus essential to pay particular attention to the economic news and its potential impact on exchange rates.

Article Details

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

References

I. A. Mohamud, “Exchange Rate Volatility: Empirical Evidence from Somalia in 2010,” Journal of Distribution Science, vol. 12, no. 3, pp. 99–103, 2014.

L. Kantar, “ARCH Models and an Application on Exchange Rate Volatility: ARCH and GARCH Models,” in Handbook of Research on Emerging Theories, Models, and Applications of Financial Econometrics, Springer, 2021, pp. 287–300.

I. Sahadudheen, “An Exponential GARCH Approach to the Effect of Impulsiveness of Euro on Indian Stock Market,” The Journal of Asian Finance, Economics and Business, vol. 2, no. 3, pp. 17–22, Aug. 2015, doi: 10.13106/JAFEB.2015.VOL2.NO3.17.

V. C. Nguyen and T. T. Do, “Impact of Exchange Rate Shocks, Inward FDI and Import on Export Performance: A Cointegration Analysis,” The Journal of Asian Finance, Economics and Business, vol. 7, no. 4, pp. 163–171, Apr. 2020, doi: 10.13106/JAFEB.2020.VOL7.NO4.163.

T. T. X. Huong, M.-L. T. Nguyen, and N. T. K. Lien, “Exchange Rate Volatility and FDI Response during the Financial Crisis: Empirical Evidence from Vietnam,” The Journal of Asian Finance, Economics and Business, vol. 8, no. 3, pp. 119–126, Mar. 2021, doi: 10.13106/JAFEB.2021.VOL8.NO3.0119.

I. Sangaré, “Exchange Rate Regimes in the ASEAN: Would a Currency Union Outperform the Independent Managed Floating Regimes?,” Journal of Economic Integration, vol. 36, no. 1, pp. 72–102, Mar. 2021, doi: 10.11130/jei.2021.36.1.72.

D. T. Hurley and R. A. Santos, “Exchange rate volatility and the role of regional currency linkages: the ASEAN case,” Applied Economics, vol. 33, no. 15, pp. 1991–1999, Dec. 2001, doi: 10.1080/00036840010023779.

D. B. Ewubare and C. D. Merenini, “The effect of exchange rate fluctuation on foreign trade in Nigeria,” International Journal of Scientific Research and Engineering Development, vol. 2, no. 1, pp. 68–85, 2019.

T. Mosbei, S. K. Samoei, C. C. Tison, and E. K. Kipchoge, “Exchange rate volatility and its effect on intra-East Africa Community regional trade,” Latin American Journal of Trade Policy, vol. 4, no. 9, pp. 43–53, 2021.

E. Ekanayake and A. Dissanayake, “Effects of Real Exchange Rate Volatility on Trade: Empirical Analysis of the United States Exports to BRICS,” Journal of Risk and Financial Management, vol. 15, no. 2, pp. 1–21, 2022.

A.-R. B. Yussif, S. T. Onifade, A. Ay, M. Canitez, and F. V. Bekun, “Modeling the volatility of exchange rate and international trade in Ghana: empirical evidence from GARCH and EGARCH,” JEAS, pp. 1–17, 2022, doi: 10.1108/JEAS-11-2020-0187.

A. Heroja, “Exchange Rate Effects on Foreign Direct Investment Decision,” 2022.

C.-H. Puah, S.-W. Yong, S. A. Mansor, and E. Lau, “Exchange Rate and Trade Balance Nexus in ASEAN-5,” Labuan Bulletin of International Business & Finance, vol. 6, pp. 19–37, 2008.

J. Lily, M. Kogid, D. Mulok, L. Thien Sang, and R. Asid, “Exchange Rate Movement and Foreign Direct Investment in Asean Economies,” Economics Research International, vol. 2014, pp. 1–10, Mar. 2014, doi: 10.1155/2014/320949.

P. T. H. An, N. T. Binh, and H. L. N. Cam, “The Impact of Exchange Rate on Economic Growth - Case Studies of Countries in the Asean Region,” vol. 9, no. 7, pp. 965–970, 2018.

S. Z. S. Abdalla, “Modelling Exchange Rate Volatility using GARCH Models: Empirical Evidence from Arab Countries,” IJEF, vol. 4, no. 3, pp. 216–229, 2012, doi: 10.5539/ijef.v4n3p216.

C. Maya and K. Gómez, “What exactly is’ Bad News’ in foreign exchange markets?: Evidence from Latin American markets,” Cuadernos de economía, vol. 45, no. 132, pp. 161–183, 2008.

A. K. Panda, S. Nanda, V. K. Singh, and S. Kumar, “Evidence of leverage effects and volatility spillover among exchange rates of selected emerging and growth leading economies,” Journal of Financial Economic Policy, vol. 11, no. 2, pp. 174–192, 2018.

T. K. D. Nguyen, “Modelling exchange rate volatility using GARCH model: An empirical analysis for Vietnam,” presented at the International Econometric Conference of Vietnam, 2018, pp. 941–952.

M. Mahroowal and H. Salari, “Modeling exchange rate volatility, using Univariate Generalized Autoregressive conditionally Hetroscedastic type models: evidence from Afghanistan,” American Journal of Economics and Business Management, vol. 2, no. 3, pp. 69–82, 2019.

R. M. Ponziani, “Foreign exchange volatility modeling of Southeast Asian major economies,” JEBAV, vol. 22, no. 2, pp. 283–297, 2019.

M. Mohsin, S. Naseem, D. Muneer, and S. Salamat, “The volatility of exchange rate using GARCH type models with normal distribution: evidence from Pakistan,” Pacific Business Review Internationsl, vol. 11, no. 2, pp. 124–129, 2019.

A. Atabani Adi, “Modeling exchange rate return volatility of RMB/USD using GARCH family models,” Journal of Chinese Economic and Business Studies, vol. 17, no. 2, pp. 169–187, 2019.

A. Abdulhakeem, S. O. Adams, and R. O. Akano, “Modelling Nigeria Naria Exchange Rate against Some Selected Country’s Currencies Volatility: Application of GARCH Model,” Asian Journal of Probability and Statistics, vol. 5, no. 1, pp. 1–13, 2019.

A. O. Ali, “Modeling Exchange Rate Volatility of Somali Shilling Against Us Dollar by Utilizing GARCH Models,” IJEFI, vol. 11, no. 2, pp. 35–39, Mar. 2021, doi: 10.32479/ijefi.9788.

S. Johamen and K. Jtiselius, “Maximum Likelihood Estimation and Inference on Cointegration - with Applications to the Demand for Money,” Oxford Bulletin of Economics and Statistics, vol. 52, no. 2, pp. 169–210, 1990.

P. K. Mishra, “The Dynamics of Relationship between exports and economic growth in India,” International Journal of Economic Sciences and Applied Research, vol. 4, no. 2, pp. 53–70, 2011.